You’ve probably heard the term “behaviour gap” thrown about in investing circles lately. It sounds fancy – maybe even a bit clinical – but it really boils down to this: it’s the cost of our own bad decisions. Not market crashes. Not inflation. Us. The gap between what we could have earned if we’d behaved sensibly, and what we actually end up with after a few panic-sells, FOMO buys, and “just-one-more-ETF” moments.

Now, that sounds simple enough, but the concept is more slippery than it looks. Because what are our “potential” returns anyway? Are we comparing ourselves to Warren Buffett? To an index fund? To a fantasy version of ourselves who never blinks when markets crash? If so, we’re setting ourselves up for failure. That person doesn’t exist – and if they do, I certainly don’t want to have dinner with them.

The Myth of the Perfect Investor

Let’s get one thing straight: we are not – and never will be – omniscient robots coolly allocating capital with machine-like precision. Most of us can’t go 30 minutes without checking our phones, never mind 30 years without fiddling with our portfolios. So let’s shelve the idea that we can reach some Zen-like investing state where we never act irrationally. That’s not the goal.

The real aim? Avoiding the really big cock-ups. The kind that don’t just dent our ego, but leave our portfolios limping for years.

Rather than fixating on an imaginary perfect strategy, we’re better off comparing reasonable decisions with disastrous ones. That’s the real behaviour gap: not the difference between genius and average, but between average and catastrophic.

Most of the Time, 'Good Enough' Is Good Enough

Investing isn’t about pulling off the occasional masterstroke. It’s about not blowing yourself up. You don’t need to win gold every time – just try not to trip over your shoelaces before the finish line.

You’ll make some dodgy decisions – we all do. You’ll miss a rally, jump on a trend too late, or sell the dip thinking it was the crash. But these things don’t usually sink the ship. It’s the big mistakes – the ones that are usually emotional, rash, or story-driven – that do the damage.

Think:

-

Never investing in the first place.

-

Selling out at the bottom when things get hairy.

-

Getting swept up in the latest investing fad because everyone else seems to be making money (hello, crypto boom… and bust, and boom, and...).

-

Constantly switching strategies like a chef changing recipes mid-cook.

Why Do We Keep Making These Mistakes?

1. Stories Rule Our Brains

We love a good story. It’s how we make sense of the world. And the financial markets? They’re a 24/7 drama machine. When things get messy, we create our own narratives to cope with the uncertainty – and we invest accordingly. The problem is, we don’t know how the story ends. So we panic, or we chase, or we ‘pivot’ right at the worst time. In hindsight, everything looks obvious. In the moment? It’s a fog.

2. Time Isn’t Just a Number

In theory, we all know that if you stay invested for 20 years, you’re likely to do pretty well. Easy peasy. But living through those 20 years? With recessions, elections, pandemics, TikTok “experts” and endless headlines screaming at you? That’s a different kettle of fish. Theory sees time as a straight line. In real life, it’s a never-ending series of gut checks.

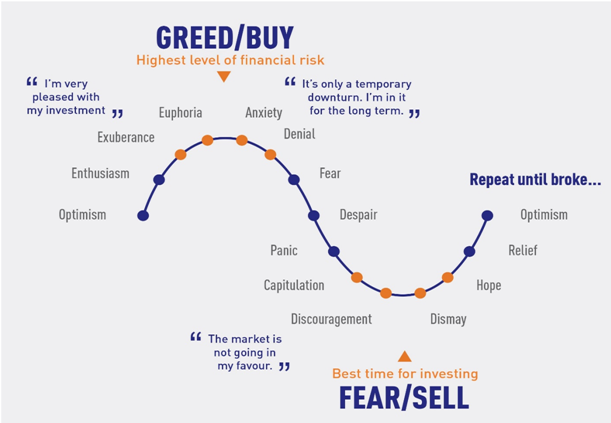

3. Emotions Make the Decisions

Investment theory is dry. It tells us markets drop 30–40% sometimes. But when your actual portfolio takes that hit? It hurts. You don’t react with a spreadsheet; you react with your stomach. Fear, greed, boredom – they’re all at the wheel far more often than we’d like to admit.

So, What Can We Do About It?

We can’t close the behaviour gap entirely, but we can build some guardrails to keep ourselves from going completely off-piste. Here are five steps worth keeping in your investing toolkit:

1. Design Your Portfolio With Reality in Mind

Diversify properly. Rebalance occasionally. Invest regularly. Think less like a textbook and more like a seasoned traveller who knows the journey gets bumpy. Your portfolio shouldn’t just look good on paper – it should be built to withstand your future self’s occasional wobbles.

2. Set Expectations Early (and Realistically)

Don’t sugar-coat the ride. Tell yourself – and anyone else involved – what could go wrong before it does. Expect a 40% drawdown. Expect your portfolio to look like a disaster at some point. That way, when it happens, you can say, “Ah, yes – this is the bit we talked about.” Far better than blind panic and regret.

3. Frame Things Properly

Language matters. Is a market drop a catastrophe? Or is it simply the entry fee for long-term gains? If you think of every dip as a disaster, you’ll behave like it is. But if you see it as an opportunity or a normal part of the process, you’ll have a much better shot at staying calm. Remember: short-term volatility is mostly a concern for traders. You’re not one of them (hopefully).

4. Control Your Environment

You are not stronger than the market noise. If you’re constantly checking prices or refreshing your investing app like it’s Instagram, you're setting yourself up for trouble. Want to drink less? Stay out of the pub. Want to make fewer knee-jerk investment decisions? Stop checking your portfolio every five minutes. Delete the app. Mute CNBC. Go for a walk.

5. Make Plans for When Stuff Hits the Fan

This is a little behavioural trick called “implementation intentions”. Basically, plan in advance how you’ll act in a certain situation. For example: “If the market drops 30%, I will invest another £X.” Will you actually do it when the time comes? Maybe. Maybe not. But having that plan gives you a fighting chance of not doing the exact opposite, which is usually what happens.

The Bottom Line

The behaviour gap isn’t about beating the market – it’s about not sabotaging yourself. Investing theory assumes we’re emotionless and rational, which is a lovely idea, but not exactly realistic. The real world involves feelings, mistakes, and distractions – and that’s fine.

We don’t need to be perfect investors. We just need to avoid the big howlers.

That’s the gap that really matters. And with a bit of awareness, some decent habits, and maybe the occasional digital detox, we stand a decent chance of keeping our investments – and our sanity – on track.

Jun 10, 2025 6:34:04 AM

%20(2200%20%C3%97%20900px)%20(1).png?width=160&height=65&name=palance%20new%20logo%20(220%20%C3%97%2090px)%20(2200%20%C3%97%20900px)%20(1).png)

.png?width=500&name=Blog%20banners%20(8).png)

.png?width=500&name=Blog%20banners%20(7).png)

Comments